Report on Operations

Customer Services

The Customer Services Department is responsible for customer service via the communication centre, insurance contract administration, the entry of contracts in systems, contract amendments, payment processing, and the handling of the entire claim settlement agenda.

One of Česká pojišťovna’s strategic objectives is to increase customer satisfaction with the services rendered. The customer satisfaction index, used to obtain customer feedback at eight selected key points of interaction on a rolling basis, increased in 2016 by one percentage point, and is of the standard expected of a mature financial institution.

Disasters were the number-one item on the claim settlements agenda in the first half of the year. In May, hail and torrential rain triggered a level-one disaster in property insurance and a level-two disaster in crop insurance. New features in the electronic inspection of motor vehicles, property and agricultural damage continued to be developed. PRM II (Partner Relationship Management), a project to improve damage control and to help customers to find suitable repair shops, was put into operation. From the point of view of customer satisfaction, we started to feel the effects of deploying a process for the accelerated settlement of small claims in the corporate segment and among SMEs. In the retail segment, we successfully pushed up the number of claims settled in simplified procedure.

We reported notable achievements in automated fraud detection, where we made full use of automated detection tools, predictive modelling and social network analysis. The RTDM (Real Time Decision Manager) project, enabling us to harness the above systems right from the start of the life insurance claim process, has reported sound results. We are keen to extend the RTDM concept to non-life claims settlement in the coming years. A particularly successful factor for us in the first half of 2016 was the level of savings made by identifying fraudulent claims.

In 2016, in our management of policies and payments, we focused on process optimisation, automation, the use of modern technology and document digitisation. In all of these areas, we placed a special emphasis on swift, smart solutions delivering high-quality modern services to both internal and external customers. In the first half of the year, we deployed the biometric signing of insurance contracts for our agents, which help to speed up the whole process, slash the error rate and subsequently deliver documentation to customers faster and more efficiently.

In 2016, we also concentrated on new premium collection technologies, so we now offer customers the possibility of paying via a mobile POS terminal or a whole range of online options.

Electronic communication has also constantly intensified to the extent that we delivered more than 44% all documents to customers via electronic channels only.

In 2016, we focused on making advances in paperless and online services. In the administration of their insurance contracts, customers can opt to have their requirements handled electronically for the majority of processes. The Česká pojišťovna Customer Zone, the self-service portal for our customers, registered surging growth, with the number of active accounts rising by 75,000 in 2016 to a total of 326,000, with visitor rates up by almost 60%. Customers can also make use of the online chat service on Česká pojišťovna’s website (including the Customer Zone). We introduced an online service enabling a selected group of customers to run rapid searches for dispatched documents by mobile phone.

In 2016, call centre operators fielded nearly 850,000 incoming calls, made 1.9 million outgoing calls, processed 1.55 million electronic and paper documents, and chatted online with 17,000 customers. In addition to handling service requests, the call centre also engaged in telephone sales of policies and the active retention of existing customers. We have now made it cheaper for customers to call our call centre by switching from a “white” line to a “national” telephone number. At very busy times, we offer customers our unique Virtual Hold service, where we call customers back instead of making them wait in line for their call to be taken.

In 2016, the Ombudsman Department took over the full-scale handling of all complaints lodged with Česká pojišťovna. Complaints are a valuable source of feedback from customers and are a great help as we seek to improve our services. Everything is carefully and professionally investigated, and it is not uncommon for initial opinions to change. We keep in contact with customers when handling their complaints. Where possible, we deal with complaints by telephone as this is a faster and more intelligible form of communication and often clears up any confusion. After evaluating complaints carefully, we then provide feedback to the competent departments in order to eliminate such complaints as fully as possible. This feedback is also presented to the Company’s management.

By enhancing service quality and efficiency, the various Customer Service units made a sizeable contribution to the overall earnings result reported by Česká pojišťovna.

Investment Policy

Financial investments stand alongside insurance and reinsurance as another important area of operations for the Company. They contribute significantly to overall Company assets and are financed primarily from insurance provisions and equity.

In keeping with an amendment to the insurance act that entered into force in September 2016, the Company makes investments based on the principle of prudent investment and a valid investment policy with the aim of achieving safety, liquidity and profitability in order to ensure that the Company is fully capable of meeting its commitments to customers.

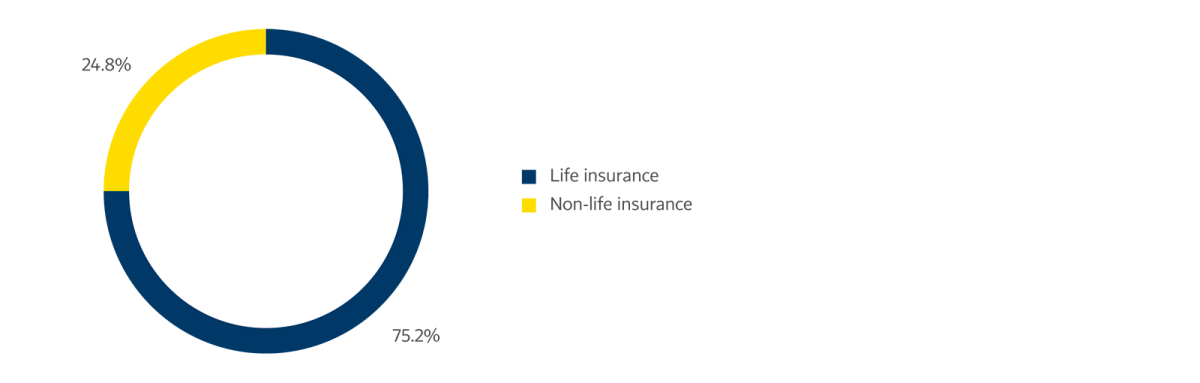

The structure and volume of the Company’s financial investments as at 31 December 2016 are shown in the graph and table entitled “Structure of Financial Investments (IFRS, Book Value), by Business Segment”.

Structure of Financial Investments (IFRS, Book Value), by Business Segment

In early 2016, concerns about the revival of the global economy prevailed on the financial markets and this marred the performance of risk-bearing assets. The central banks responded with a more accommodative monetary policy stance. Among other things, the ECB cut the deposit rate to -0.4%, while the Czech National Bank extended the likely end of its exchange rate commitment until mid-2017. These interventions buoyed the bond markets. Bond yields bottomed out in the summer following the surprise result of the UK’s referendum on whether to remain in the EU. The markets shrugged off their initial shock remarkably quickly, and the same can be said of Donald Trump’s election as the US president, which triggered equity market growth and tempered yield increases. The Czech market was also exposed to these developments and, starting in the summer, was also subject to mounting speculation that monetary policy would soon be relaxed. In 2016 as a whole, the CNB purchased EUR 16.8 billion in new reserves. The influx of speculative capital complicated matters for Czech investors because it kept the yields of Czech government bonds in negative territory, while the high costs of currency hedging severely degraded the attractiveness of investments abroad. The loosening of the exchange rate commitment remains a key event for the Czech market in 2017. The CNB has pledged that this will happen in the second quarter at the earliest. This relaxation of the commitment could normalise relations on Czech markets, but high volatility is also probable. In the first half of the year, another major source of volatility and uncertainty will be the elections in a string of key European countries, spearheaded by France. The gradual rises in interest rates in the US and whispers of a tighter monetary policy in Europe are further potential risks. Mercifully, inflation remains under control and the central banks can be patient. Furthermore, the performance of credit and equity markets should be boosted by the encouraging outlook for the global and European economies.

Financial Investments within the Life Insurance Segment

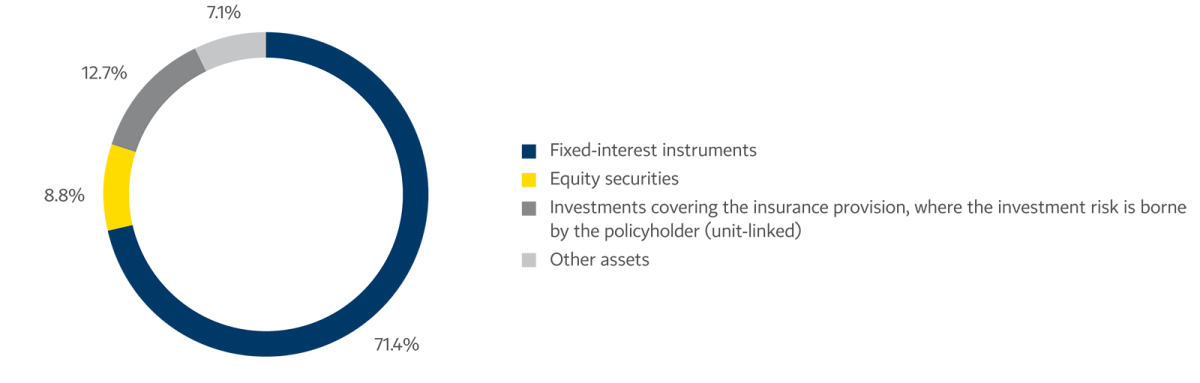

At the end of 2016, the life insurance segment contained a total of CZK 62.6 billion in financial investments. Of this amount, CZK 7.9 billion (12.7%) comprised investments covering provisions for unit-linked policies where the investment risk is borne by the policyholder. In the segment of regular-premium insurance, unit-linked life insurance continues to account for most newly concluded contracts, which means that the share of the corresponding provisions in overall life insurance provisions will continue to rise in the future. The remaining financial investments in the life segment are financed by conventional life insurance provisions and by a portion of the Company’s own equity allocated to this segment. For the most part, this money is invested in fixed-income instruments (CZK 44.7 billion), consisting mainly of debt securities (CZK 39.7 billion), especially Czech and foreign government bonds and corporate bonds of issuers generally with an investment grade rating.

In accordance with a feature typical for life insurance liabilities, i.e. their longer time frame, debt securities covering life insurance provisions have, on average, longer to maturity. The aim is to safeguard a sufficient and stable yield in the long run that will enable obligations arising from insurance contracts to be met. In terms of accounting classification, 94% of debt securities are classified as available-for-sale financial assets, so as to align the reporting of their result with the method used to account for insurance liabilities and reduce earnings volatility resulting from changes in market interest rates.

Structure of Financial Investments (IFRS, Book Value), by Life Insurance Business Segment

The third largest group, by volume, in the structure of financial investments comprises equity securities (shares, unit certificates, and other variable-yield securities), accounting for 8.8%, or CZK 5.5 billion in absolute terms, as at 31 December 2016. These instruments are purchased for the portfolio to act as a counterweight to fixed-interest instruments for purposes of risk diversification and to optimise overall medium- and long-term returns.

The investment portfolio is rounded out by other fixed assets. Here, Česká pojišťovna has investments in buildings and land, taking the form of direct ownership of real estate or equity in companies which own the real estate and engage in the management and letting thereof as their core activity. In the past few years, allocations to this investment segment have been steadily growing, and at the end of the year investments here had a book value of CZK 4.5 billion (a share of 7.1%). Against a background of low interest rates, investment property is a suitable source of higher, long-term stable yield, and also offers the opportunity of capital gains as the market price of the property rises.

The gross return on life financial investments, before the deduction of management fees, was CZK 2.17 billion. Of this amount, investments covering insurance provisions where the risk is borne by the policyholder accounted for CZK 358 million. Interest on debt securities was the biggest source of returns.

Financial Investments within the Non-life Insurance Segment

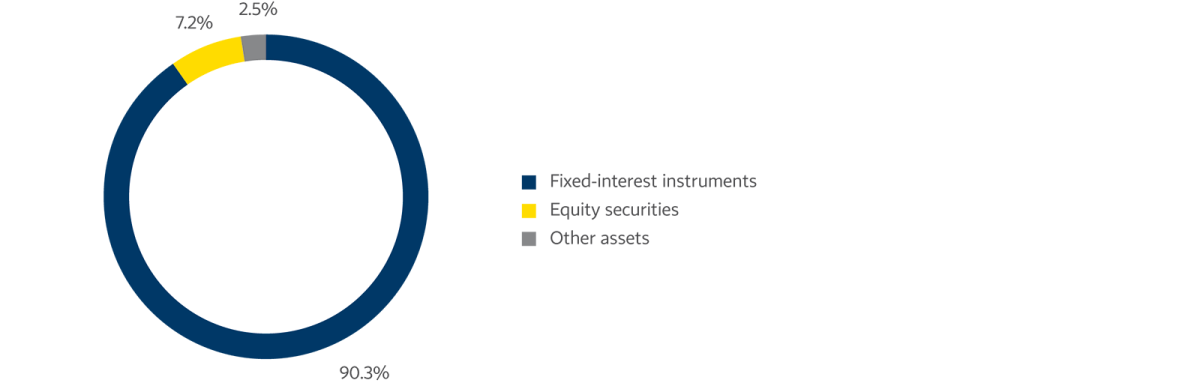

Investments in the non-life segment are financed by non-life insurance technical provisions and the equity allocated to this segment. Since non-life liabilities are shorter than life liabilities, there are more assets with shorter times to maturity in the investment portfolio, as well as more liquid instruments, which can be readily converted into cash when needed to pay insurance claims.

As at 31 December 2016, the book value of the non-life insurance portfolio was CZK 20.6 billion; 89% (CZK 18.4 billion) of the portfolio consisted of fixed-income instruments, of which debt securities had a book value of CZK 16.9 billion, receivables under reverse repo transactions with CNB bills CZK 1.1 billion, and term deposits with banks CZK 0.5 billion. Of the remainder, 8.3% of the portfolio was invested in equity securities and 2.7% in other assets. Defined by accounting classification, the overwhelming majority of financial investments are classed as available-for-sale assets.

Structure of Financial Investments (IFRS, Book Value), by Non-life Insurance Business Segment

The total return on financial investments within the non-life insurance segment, before the deduction of management expenses, was CZK 460 million in the first half of 2016. As in the life insurance segment, the biggest contributor to this result was interest income from bonds.

Structure of Financial Investments (IFRS, Book Value), by Business Segment

| Life Insurance | Non-life Insurance | |||

|---|---|---|---|---|

| CZK thousands | % | CZK thousands | % | |

| Buildings and land (fixed assets) | 4,472,133 | 7.14 | 553,860 | 2.68 |

| Loans | 7,036,273 | 11.23 | 1,139,912 | 5.52 |

| Unlisted debt securities | 927,135 | 1.48 | 0 | 0.00 |

| Loans and advances provided under repo transactions | 5,497,337 | 8.78 | 1,139,912 | 5.52 |

| Other loans | 611,801 | 0.98 | 0 | 0.00 |

| Available-for-sale financial assets | 42,931,914 | 68.55 | 17,680,219 | 85.60 |

| Debt securities | 37,402,677 | 59.72 | 15,957,560 | 77.26 |

| Shares, unit certificates and other variable-yield securities | 5,529,237 | 8.83 | 1,722,658 | 8.34 |

| Financial assets at fair value through profit or loss | 9,527,538 | 15.21 | 987,270 | 4.78 |

| Debt securities | 1,412,161 | 2.25 | 973,558 | 4.71 |

| Shares, unit certificates and other variable-yield securities | 175 | 0.00 | 0 | 0.00 |

| Investments covering provisions for policies where the investment risk is borne by the policyholder | 7,926,144 | 12.66 | 0 | 0.00 |

| Positive market value of derivatives | 189,058 | 0.30 | 13,712 | 0.07 |

| Other investments | 0 | 0.00 | 489,003 | 2.37 |

| Fixed-term bank deposits (net of inward reinsurance deposits received) | 0 | 0.00 | 489,003 | 2.37 |

| Financial liabilities (net of bonds outstanding) | (1,335,632) | (2.13) | (196,226) | (0.95) |

| Loans and advances received under repo transactions | 0 | 0.00 | 0 | 0.00 |

| Negative market value of derivatives | (1,335,632) | (2.13) | (196,226) | (0.95) |

| 62,632,225 | 100.00 | 20,654,038 | 100.00 | |

Reinsurance

Česká pojišťovna’s reinsurance programme is a long-term contributor to the Company’s balanced earnings and stability. As a risk management tool, reinsurance protects Česká pojišťovna, along with its customers and shareholders, from unexpected individual or catastrophic events, as well as from random variations in loss frequency. Analyses of reinsurance needs and the optimisation of the reinsurance structure take place using modern dynamic financial analysis tools in collaboration with Holding Company experts and with the support of reinsurance brokers. Each year, the reinsurance programme is modified by the Holding Company to ensure that it reflects changes in the portfolio and the product line.

Česká pojišťovna’s principal and obligatory reinsurance partner is the Group’s captive reinsurer, GP Reinsurance EAD, based in Bulgaria. Through GP Reinsurance EAD, risks are further retroceded into the Group’s reinsurance contracts by Assicurazioni Generali. Thanks to this optimisation, Česká pojišťovna can profit from the advantages of Group coverage and thereby further reduce reinsurance costs while expanding coverage terms. Group rules determine the maximum possible exposure that Česká pojišťovna may have to each type of insurance.

Thanks to intensive work detailing information on individual risks in the portfolio, Česká pojišťovna is able, through the use of sophisticated models, to control its exposure to risks arising from catastrophes. Currently, flood losses are modelled regularly over the personal lines, commercial lines, and large risks portfolios. Gale exposure is modelled in a similar structure.

Česká pojišťovna is perceived by partners and affiliates as a stable and strong reinsurance partner in its own right. This fact is reflected in the volumes of obligatory and facultative reinsurance in the area of corporate customers and large risks.

Nuclear Pool

The Czech Nuclear Insurance Pool (“CNIP”) is an informal consortium of non-life insurers based on the co-insurance and reinsurance of nuclear risks. For more than 20 years, the CNIP has offered insurance and reinsurance services for liability and property risks, including risks related to the transportation of nuclear material. Insurers on the Czech market do not usually insure nuclear risks on their own due to the specific nature of those risks, which are typically excluded from coverage. The insurers in the CNIP each provide their own net lines, the sum of which forms the overall capacity of the CNIP for individual types of insured risks. Within the CNIP, an Agreement on the Joint and Several Liability of Members is concluded every year to increase security and trust in the CNIP.

Česká pojišťovna a.s. is one of the founding members of the CNIP and, since the outset, has been the lead insurer by agreement with those companies involved. Within Česká pojišťovna a.s., nuclear risks are in the competence of the Corporate and Industrial Insurance Department (the “GCC”). The CNIP’s executive body is the CNIP Office, which is incorporated into the Operations and IT Department within the GCC. Česká pojišťovna a.s.’s net exposure to the CNIP was increased fractionally in 2016.

Human Resources

At the end of 2016, employees numbered 4,410, of whom 4,020 were full-time contracted employees and 390 were hired under “agreements on the performance of work” or “agreements on work activities”.

The Company annually refines its core appraisal principles, consisting of an emphasis on positive motivation and the identification and harnessing of the strengths of individuals. The employee development and remuneration systems are linked to the employee appraisal system. Top-rated employees benefit from the most systemic development support.

In employee development, Česká pojišťovna concentrates on strengthening expertise and fostering insurance know-how. We are expanding the involvement of internal trainers in employee training in line with the principle of a self-learning organisation. We are forging ahead with afternoon workshops and with the Insurance Academy (Pojišťovácká akademie), which is particularly important for new colleagues. The chief sponsor of the programme is the CFO.

In 2016, we also developed specific programmes for key groups, such as talents, graduates and managers, preparing intensive annual training courses geared towards their professional advancement. Česká pojišťovna makes systematic use of development instruments such as Customer Day (a day spent with a mentor in the front line). The prime objectives are to forge strong bonds between back-office teams and the front line, and to nurture teamwork.

In an effort to retain key employees and to prevent the loss of unique know-how, a scheme aimed at identifying, promoting and retaining employees with unique expertise has been prepared. Mobility (Mobilita), a programme designed to broaden career opportunities within the Company and the Generali Group, also continued in 2016.

Building on the results of an employee poll and in an attempt to improve employee care, we are developing benefits in areas that reflect the key lifestyle needs of our employees. One of these areas is health care, with a stress on disease prevention, physical fitness, mental well-being and healthy eating, all wrapped up in the WE FIT programme.